Energy 3x Etf

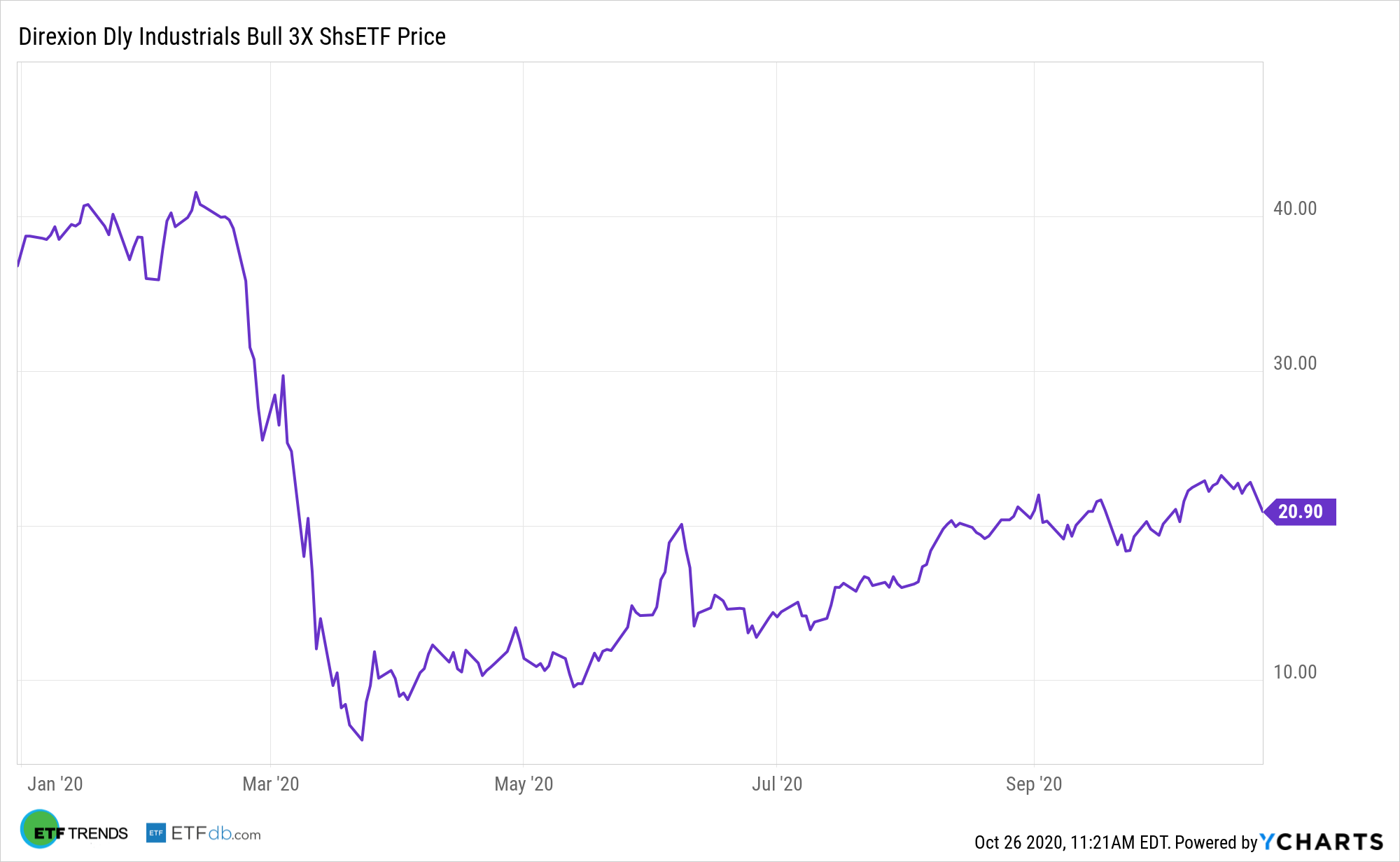

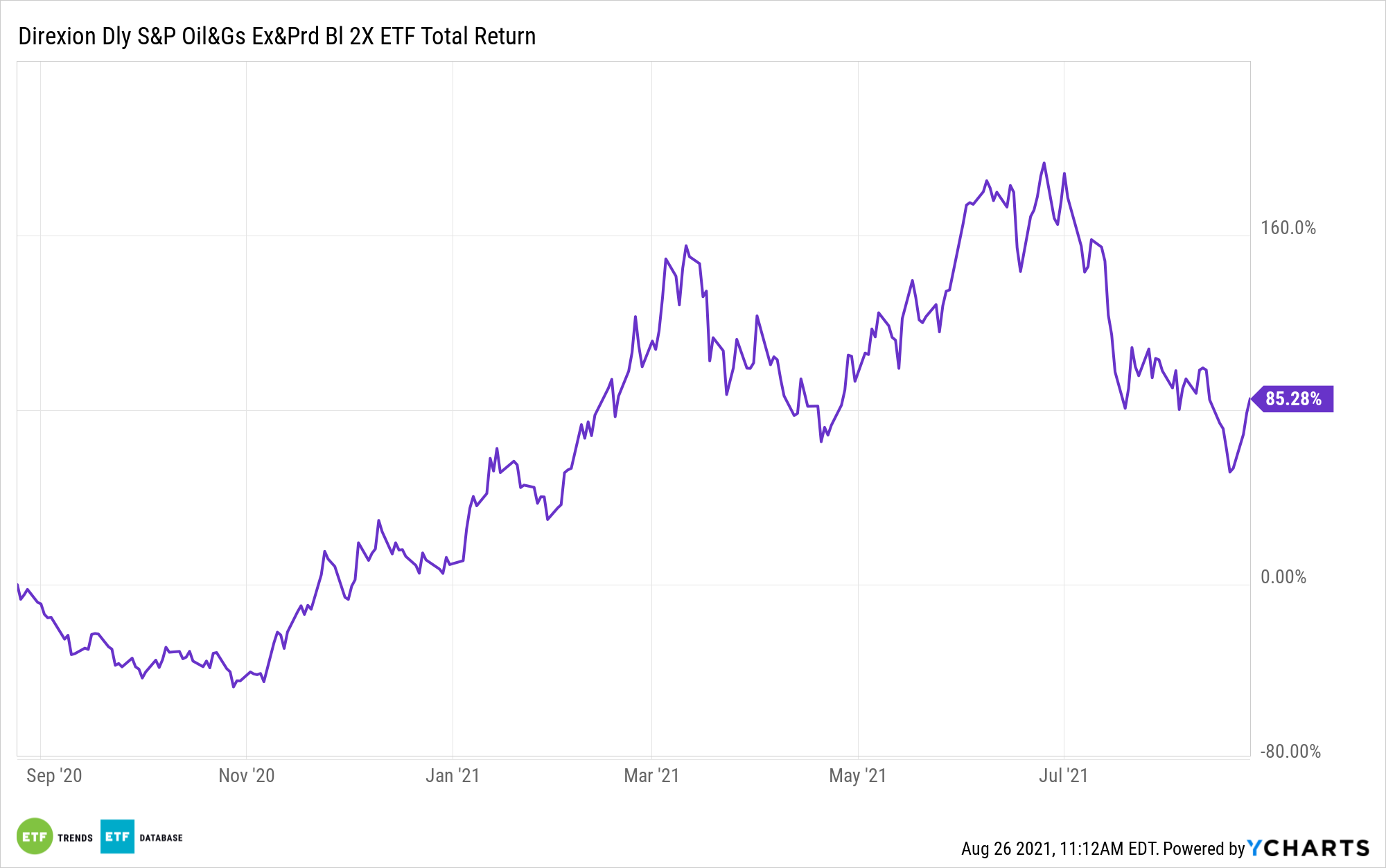

Several other leveraged energy ETFs saw extreme declines on Monday including the Direxion Daily SP Oil Gas Exp. As long-only funds they do not provide short or inverse exposure.

Click To See More Information On Gold Etfs Including Historical Performance Dividends Holdings Expense Ratios Portfolio Management Income Investing Equity

Direxion Daily Junior Gold Miners Index Bear 3X Shares.

Energy 3x etf. This can include crude oil coal heating oil gasoline and natural gas. Keep in mind that which ETFs and exchange-traded notes ETNs can be traded might change by the day. Leveraged 3X LongBull ETF List.

Leveraged Energy ETF List. Magnify your short-term perspective with daily 3X leverage. Leveraged 3X Energy Commodity ETFs seek to provide investors with a magnified daily or monthly return on a single commodity or basket of various energy commodities.

Our leveraged ETFs are powerful tools built to help you. Direxion Daily Energy Bull 3X Shares. For some 3x energy ETFs Mondays market mega-drop meant an extra-wild ride.

Still for ETF investors who are bullish on the energy sector for the near term either of the above products can be an interesting choice. Energy funds that are both leveraged and inverse. Big Oil Index 3X Leveraged ETN NRGU.

Leveraged 3X ETFs are funds that track a wide variety of asset classes such as stocks bonds and commodity futures and apply leverage in order to gain three times the daily or monthly return of the respective underlying index. Leveraged Energy ETFs seek to provide investors with a magnified daily or monthly return on a single subsector of the energy markets. Direxion Daily SP Oil Gas Exploration Production Bear 3x Shares DRIP The Direxion Daily SP Oil Gas Exploration Production Bear 3X Shares ETF provides 3x inverse daily exposure to an equal-weighted index of the largest oil and gas exploration and production companies in the US.

3x ETFs Exchange Traded Funds An exchange-traded fund or ETF is an investment product representing a basket of securities that track an index such as the Standard Poors 500 Index. ETFs which are available to individual investors only through brokers and advisers trade like stocks on an exchange. The funds use futures contracts to accomplish their goals and can be either long or inversed.

Whether youre a bull or a bear Direxion is with you. Click on the tabs below to see more information on Leveraged 3X ETFs. The funds use futures contracts to accomplish their goals and can be.

ETFs which are available to individual investors only through brokers and advisers trade like stocks on an exchange. Energy Select Sector SPDR Fund ticker. Consider these seven energy ETFs now.

80 rows 3x Energy ETF. 3x ETFs Exchange Traded Funds An exchange-traded fund or ETF is an investment product representing a basket of securities that track an index such as the Standard Poors 500 Index. Go where theres opportunity with bull and bear funds for both sides of the trade.

XLE With almost 9 billion in assets under management the XLE fund is perhaps the preeminent energy ETF on Wall. ETFs which are available to individual investors only through brokers and advisers trade like stocks on an exchange. 80 rows 3x ETFs Exchange Traded Funds An exchange-traded fund or ETF is an investment.

ETFs which are available to individual investors only through brokers and. This is helpful for advanced ETF investors who like to utilize inverse and leveraged exchange-traded funds and notes. Leveraged 3X Energy Commodity ETF List.

Stay agile with liquidity to trade through rapidly changing markets. Such ETFs come in the long and short varieties. Bull 3X Shares GUSH and.

Leveraged 3X LongBull ETFs are funds that track a wide variety of asset classes such as stocks bonds and commodity futures and apply leverage in order to gain three times the daily or monthly return of the underlying index. The Direxion Daily Energy Bull ERX and Bear ERY 2X Shares seeks daily investment results before fees and expenses of 200 or 200 of the inverse or opposite of the performance of the Energy Select Sector IndexThere is no guarantee the funds will meet their stated investment objectives. 3x ETFs Exchange Traded Funds An exchange-traded fund or ETF is an investment product representing a basket of securities that track an index such as the Standard Poors 500 Index.

78 rows ETF issuers are ranked based on their aggregate 3-month fund flows of their ETFs. Trade the energy sector with these ETFs. This can include refiners oil services stocks MLPs and crude andor natural gas producers.

A long list of companies and different financial instruments exist where the Renewable Energy exchange-traded funds may invest the money collected from the ETF investors. Why These Leveraged Energy ETPs Tanked. Below is a small sample of companies whose stocks may qualify for investment by Renewable Energy ETFs though there can be many more businesses and financial instruments.

Direxion Daily Semiconductor Bear 3x Shares. An exchange-traded fund or ETF is an investment product representing a basket of securities that track an index such as the Standard Poors 500 Index.

Leveraged Or Bust 3 Direxion Etfs For The Truly Bold Etf Trends

3 Leveraged Etfs That Could Profit From A Blue Wave Etf Trends

Why Plug Power Stock Jumped Again Today The Motley Fool In 2021 The Motley Fool The Fool Power

Igbh Etf Guide Stock Quote Holdings Fact Sheet And More Stock Quotes Ishares Corporate Bonds

High And Low Reversals Indicator Day Trading Strategy Usethinkscript Trading Strategies Day Trading Trading Quotes

This Leveraged Direxion Etf Is Up 330 Leveraged Inverse Channel

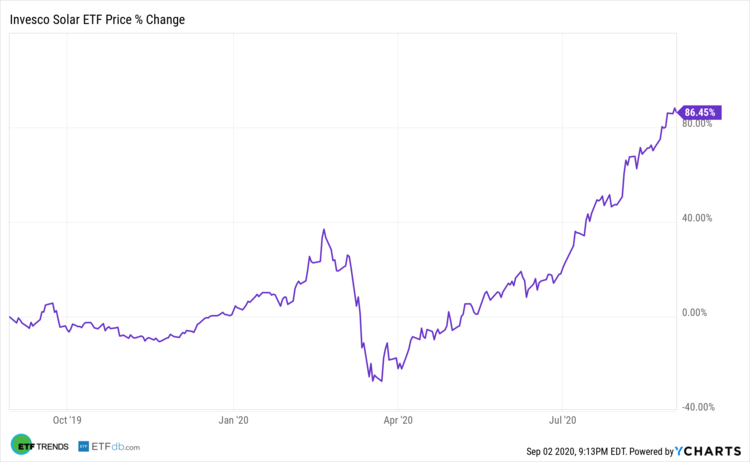

The Sun Shines On Solar Industry And This Etf

A Potent Etf Combo For Two Barometers Of Economic Health

Tesla Elonmusk Analysis Stock Analysis Investing Apps Tesla

Trading Red To Green Move Stocks Is A Very Lucrative Trading Strategy We Teach You How To Profit Using Red Green Trading Trading What Is Red Swing Trading

No September Slide For The Energy Sector And This Leveraged Etf Nasdaq

Long Term Treasury Bond Etfs Tlt Tmf Are Setting Up For Bullish Trend Reversal In The Near To Intermediate Term Click Chart A Treasury Bonds Bond Reverse

Two Etfs To Play Energy And Oil Price Volatility Nasdaq

Posting Komentar untuk "Energy 3x Etf"